Top Guidelines Of Union First Funding Bbb

Table of ContentsThe Buzz on Union First Funding ReviewsUnion First Funding Legit for BeginnersUnknown Facts About Union First Funding BbbExamine This Report about Union First Funding Bbb

Please Enable Cookies is utilizing a security solution for protection against on-line assaults. The solution requires full cookie support in order to see this internet site. Please enable cookies on your internet browser as well as try once more. is using a safety and security service for protection against on the internet strikes. This procedure is automated. You will be rerouted once the recognition is full.

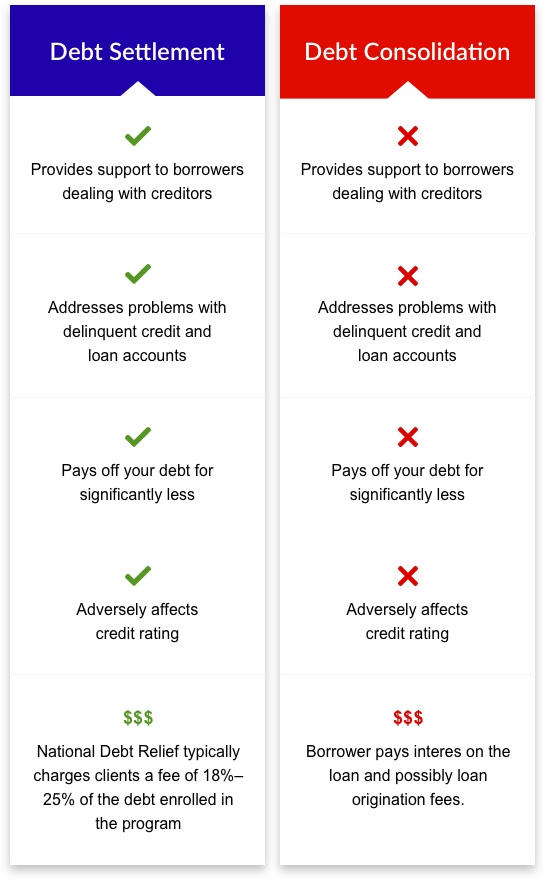

When it comes to debt consolidation, it's important to be mindful of the benefits as well as negative aspects prior to you take on new financial debt., involves taking out a new loan to pay off multiple debts or credit report card equilibriums.

Various other advantages consist of having less payments to make each month, and less chance that you'll be late on settlements. What you seldom read about are the downsides of debt consolidation. Depending upon the terms of your brand-new funding, it's possible you can in fact finish up paying much more in interest over the life of the lending, or that you'll wind up much more deeply in financial debt - union first funding.

It's an extremely effective strategy that has helped a number of our clients. Discover more currently about financial obligation monitoring, along with debt loan consolidation benefits and disadvantages.

Union First Funding Things To Know Before You Buy

Yet is debt loan consolidation an excellent option for you? Continue reading to discover about the various debt consolidation alternatives as well as the benefits and drawbacks of each. (To learn more about different ways to manage arrearages, see Choices for Handling Your Debt.) What Is Debt Debt consolidation? With financial obligation loan consolidation, you obtain a solitary finance to pay off all of your smaller financings, consequently leaving you with simply one monthly settlement instead than a number of - union first funding bbb.

The objective is to reduce the rate of interest rate as well as the regular monthly payment while paying off your debt much more quickly.

Credit score cards are instances of unsecured car loans.

The Ultimate Guide To Union First Funding

If you have a life insurance coverage plan with cash value, you might be able to acquire a car loan versus the plan. Any of these might be made use of for financial debt consolidation. Pros of Consolidating With a Safe Financing Frequently, safe loans carry lower interest rates than unsecured financings so they may save your cash on passion repayments.

Rate of interest paid on finances secured by genuine estate is in some cases allowed as a tax reduction. Secured financings are generally less complicated to obtain due to the fact that they bring less threat for the loan provider.

If you can not pay the finance back, you might lose your residence, automobile, life insurance policy, retired life fund, pop over to these guys or whatever else you could have used to protect the finance. Specific properties, such as life insurance Discover More Here policy or retired life funds could not be available to you if the loan is not paid back before you need to use them.

This can trigger the total rate of interest that you pay over the life of the combination finance to be more than the interest would have been on the specific financial obligations, although the regular monthly repayment is lower. Financial Obligation Combination Via Unsecured Loans While unsecured individual financial debt combination loans utilized to be rather common, they are much less likely to be offered to people who need them today.

Getting My Union First Funding To Work

Approving a no passion, or reduced passion, initial rate on a charge card is usually used as a replacement for an unsafe individual loan for debt consolidation. Pros of Consolidating With an Unsecured Finance The biggest benefit to an unsafe financial debt consolidation finance is that no residential property is at danger.

Disadvantages of Settling With More about the author an Unsafe Lending An unsecured debt combination lending may be tough to obtain if you do not have admirable credit score. A lot of individuals who need financial obligation combination fundings could not qualify.

American consumer financial obligation has reached $14. 35 trillion, including home loans, vehicle loan, credit cards and trainee financings, according to the New York Federal Reserve. Some Americans are incapable to handle the thousands of bucks of financial debt that they have, requiring them to check out other options as opposed to attempting to try an ever-growing hill.